The Electric Potential of the Inflation Reduction Act

A year has passed since Congress passed the Inflation Reduction Act (IRA) — the greatest climate investment in the history of our nation — and we’re just getting started.

Money has been available all year for electric vehicle buyers, who can now receive $7,500 off the purchase of a new electric vehicle, unlocking more than $1,000 a year in average fuel savings. Households who install heat pumps or heat pump water heaters today will receive up to $2,000 back when they file their taxes next year. States can apply for funding for up to $14,000 in electrification rebates targeted at low- and moderate-income households.

Over the last several months, we have been refining our estimates to reflect what we're seeing in the market, the latest analysis on the sources of U.S. emissions, and the adoption rate we need to see to meet our climate goals — what we’re calling the Pace of Progress. So, drumroll… We are changing some of our most important numbers in how we talk about the potential for Americans and the transition we need to make as a country. And we wanted to be completely transparent about that.

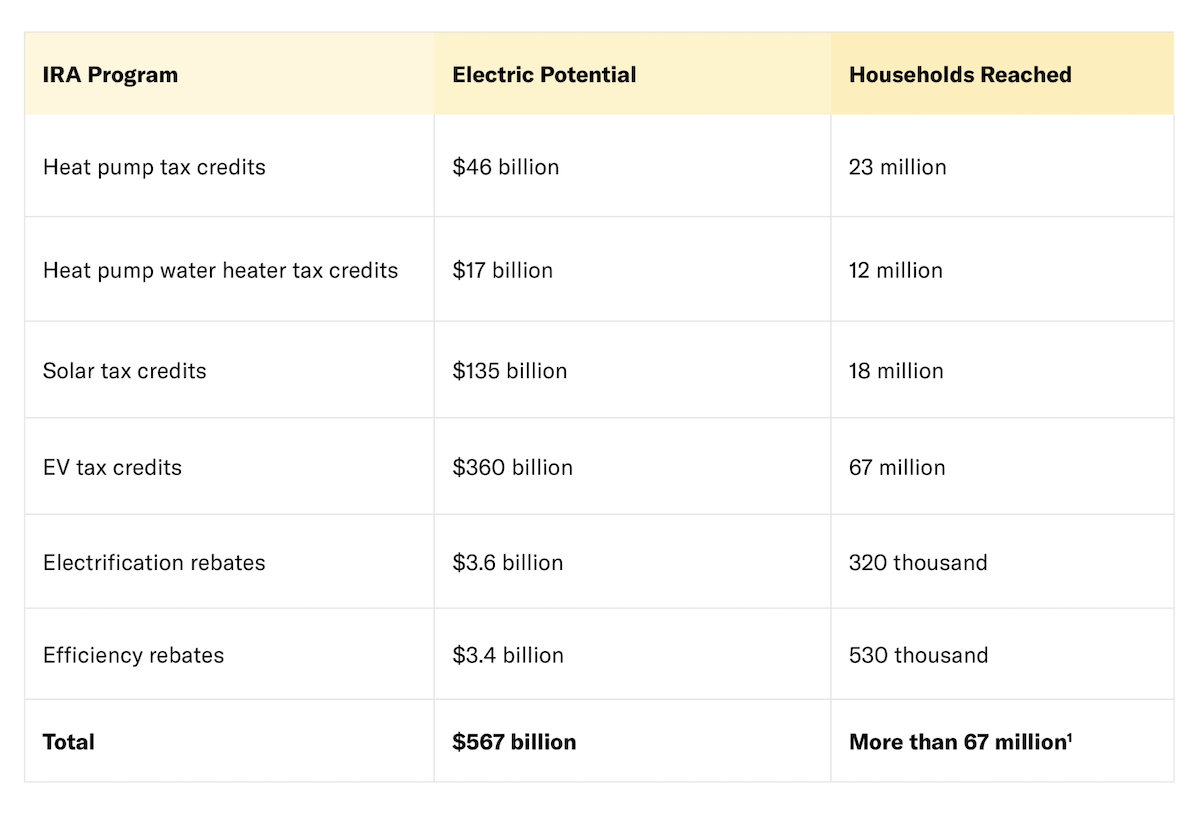

Because so many of these IRA household electrification benefits are uncapped by design, the amount of investment that could flow to American households and communities is enormous. Indeed, we estimate that IRA investment in household electrification alone could be as large as $567 billion — reaching more than 65 million households over the next ten years.

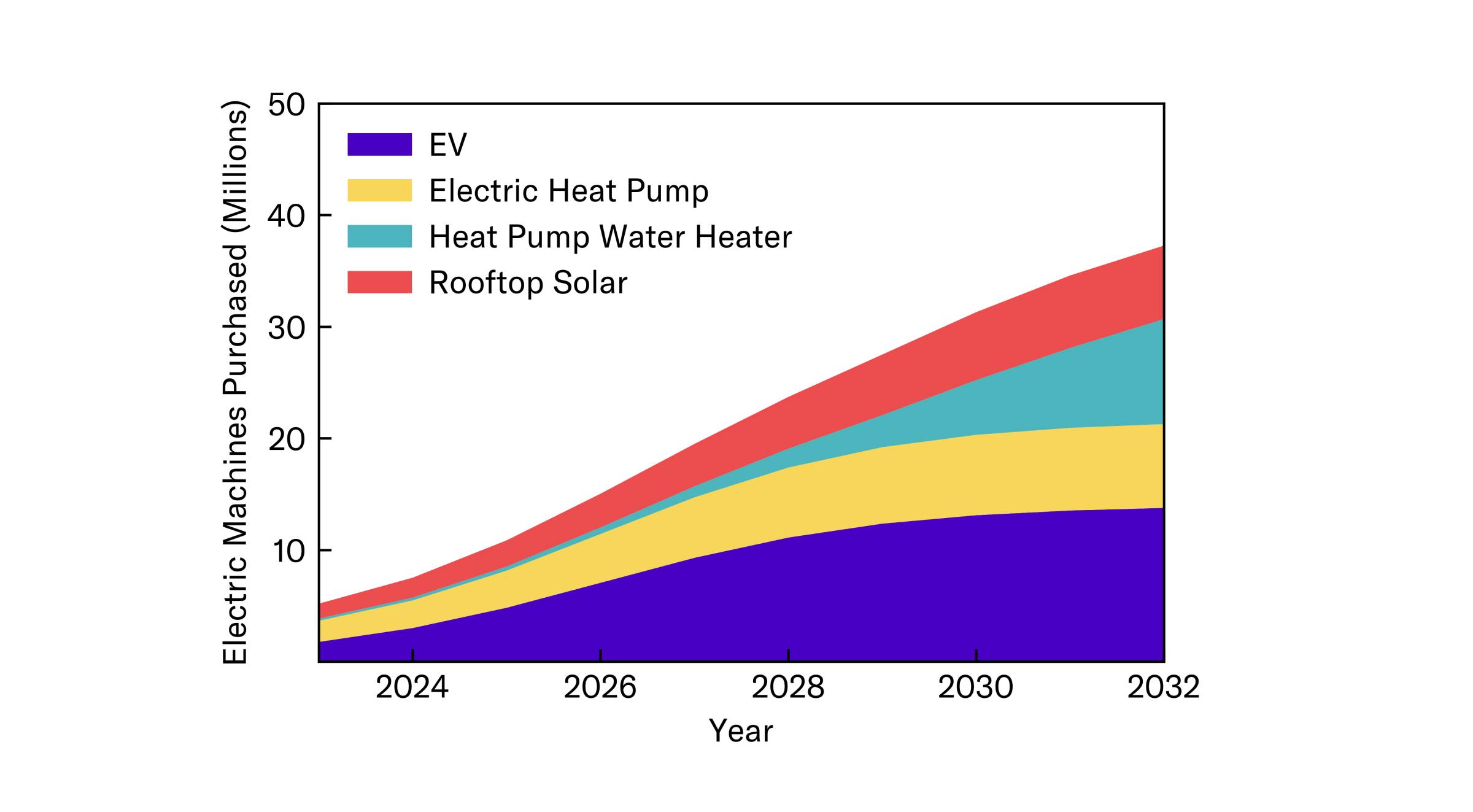

We calculate this number using the adoption curves from our Pace of Progress report. These adoption curves tell us how many American households must purchase clean, electric machines — heat pumps, heat pump water heaters, rooftop solar panels, and EVs — between now and 2032.

We then calculate how many of those households are eligible for tax credits and rebates through the IRA. The 40% of American households who owe no federal income taxes cannot access most of the IRA tax credits, since they are nonrefundable, and many renters cannot electrify their household appliances. However, the EV tax credits become transferable to dealers in 2024, effectively converting them into point-of-sale rebates which are accessible to everyone except

the highest income households. (See our methodology below for more details.)

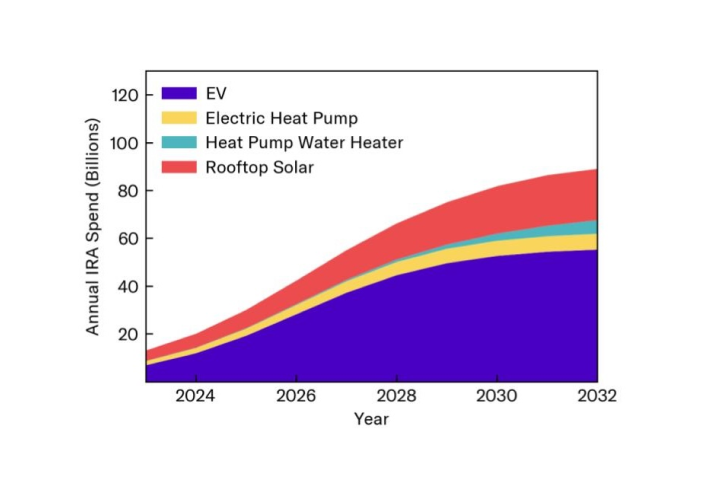

As adoption of electric technologies accelerates, the annual IRA investment flowing to household electrification increases from around 20 billion dollars annually in the early years to nearly 100 billion dollars annually by 2032.

Across all four electric technologies, we calculate that the cumulative IRA investment in household electrification between 2023 and 2032 could be as much as $567 billion. We break

that investment down by program in the table below:

It is our mission to make sure all eligible American households take advantage of the rebates

and tax credits available to them. To that end, we are launching new tools this fall to help make electrification easy for all American households.

For example, state-specific versions of our calculator will show people all the incentives available to them, from federal to state to their local utility, while our Personal Electrification Planner will present households with a step-by-step guide to each electrification project, as well as personalized costs and savings. We recently launched homes.rewiringamerica.org, which provides practical information about electrification projects to both owners and renters.

The IRA has the potential to kick off a massive transformation of our households from the fossil fuel default to clean, efficient, electric alternatives — but only if we make it so. Let’s ensure that the IRA meets its full electric potential, and delivers $567 billion of investment into our homes and communities over the next 10 years.

Methodology

Our Pace of Progress report outlines how many clean, electric machines Americans must purchase each year between now and 2050 to meet our climate goals. Historically, when a

new technology gains popularity, such as a cell phone or a color TV, adoption of that technology usually follows an S-shaped curve, starting off slowly and accelerating as the technology reaches the majority. We assume that adoption for electric technologies will proceed similarly, and we model the adoption curves required for our households to be fully electric by 2050. We use these Pace of Progress adoption curves for heat pumps, heat pump water heaters, EVs, and rooftop solar to estimate how many electric machines will be purchased each year, and therefore what the IRA incentive levels will be.

We calculate the incentive amount per household and the percent of households eligible for each tax credit or rebate program as follows:

Heat pump tax credits. Since the average cost of a heat pump is around $16,000, and the heat pump tax credits apply to 30% of the total project cost up to $2,000, we assume that every household who receives the heat pump tax credits gets $2,000 (30% of $16,000 is greater than $2,000).

40% of households owe no federal income taxes and these tax credits are nonrefundable, so 40% of households cannot access the heat pump tax credits. We also conservatively assume that no renters will be able to upgrade their space heating system, so we must add the percentage of households who are renters and who do owe federal income taxes to that 40%. Although whether or not a household owes taxes is not simply a function of household income, we use income as a proxy for tax liability, finding that about 40% of households in the US make under $50,000 a year, and thus approximate that households making under $50,000 typically owe no federal income taxes. Looking at the percentage of renters who make over $50,000 a year, we find that 16% of households are renters who likely owe federal income taxes. 56% of American households are therefore unlikely to be able to access the heat pump tax credits.

All in, considering the percentage of households who owe federal income taxes and own their homes, we estimate that 44% of households in the U.S. can access the heat pump tax credits.

Heat pump water heater tax credits. Since the average cost of a heat pump water heater is around $4,600, and the heat pump tax credits in 25C apply to 30% of the total project cost up to $2,000, we assume that every household who receives the heat pump water heater tax credits will get $1,380 (30% of $4,600). The 44% of households that we estimated to be eligible for heat pump tax credits above would also be eligible for the heat pump water heater tax credits.

Solar tax credits. According to LBNL, the average cost of a solar install is $24,700, so the average solar tax credit is 30% of that, or $7,410. Again, the same 44% of households eligible for the heat pump tax credits would also be eligible for the solar tax credits.

EV tax credits/rebates. The new EV tax credits provide $7,500 for a new vehicle to any household making under $150,000 (single), $225,000 (head of household), or $300,000 (joint filers). The used EV tax credits provide $4,000 for a used vehicle to any household making under $75,000 (single), $112,500 (head of household), and $150,000 (joint filers).

To determine the percentage of households eligible for the used and the new EV tax credits, we look at census data of income by household type and calculate the percentage of total households that fall below the caps above. We estimate that 70% of households are able to access the used EV tax credits, and 88% of households are able to access the new EV tax credits. We assume that all eligible households can access the EV tax credits, even if they do not owe taxes, since they effectively turn into point-of-sale rebates next year when they become transferable to dealers.

Due to the slow ramp-up of our Pace of Progress adoption curves in the early years, we expect that enough EVs will be manufactured domestically within a few years that the incentive amounts will not be limited by the domestic manufacturing requirements.

We also incorporate the EV charger tax credit, which is 30% of the cost of an EV charger for households living in rural or low-income areas. We calculate the percentage of census tracts that qualify for this tax credit to be 60%, and we assume that each household receives $500, given an average EV charger cost of $1,500.

Electrification rebates and efficiency rebates. Unlike the uncapped tax credit programs, these two IRA programs are budget-limited. We assume that these rebates are capped at current IRA allocation levels. The electrification rebates will invest $3.6 billion in household electrification — 80% of $4.5 billion, with the other 20% set aside for administrative costs. The efficiency rebates will invest $3.4 billion in household electrification — 80% of $4.3 billion, with the other 20% set aside for administrative costs. (An additional $200 million within the efficiency rebates is set aside for workforce programs.)

Putting it all together. We multiply the tax credit or rebate amount by the number of electric machines purchased each year (as required by our Pace of Progress report), then multiply by the percentage of eligible households, to calculate the annual IRA investment in household electrification. This investment is broken down by program in the table above, and totals $567 billion over the duration of the IRA.